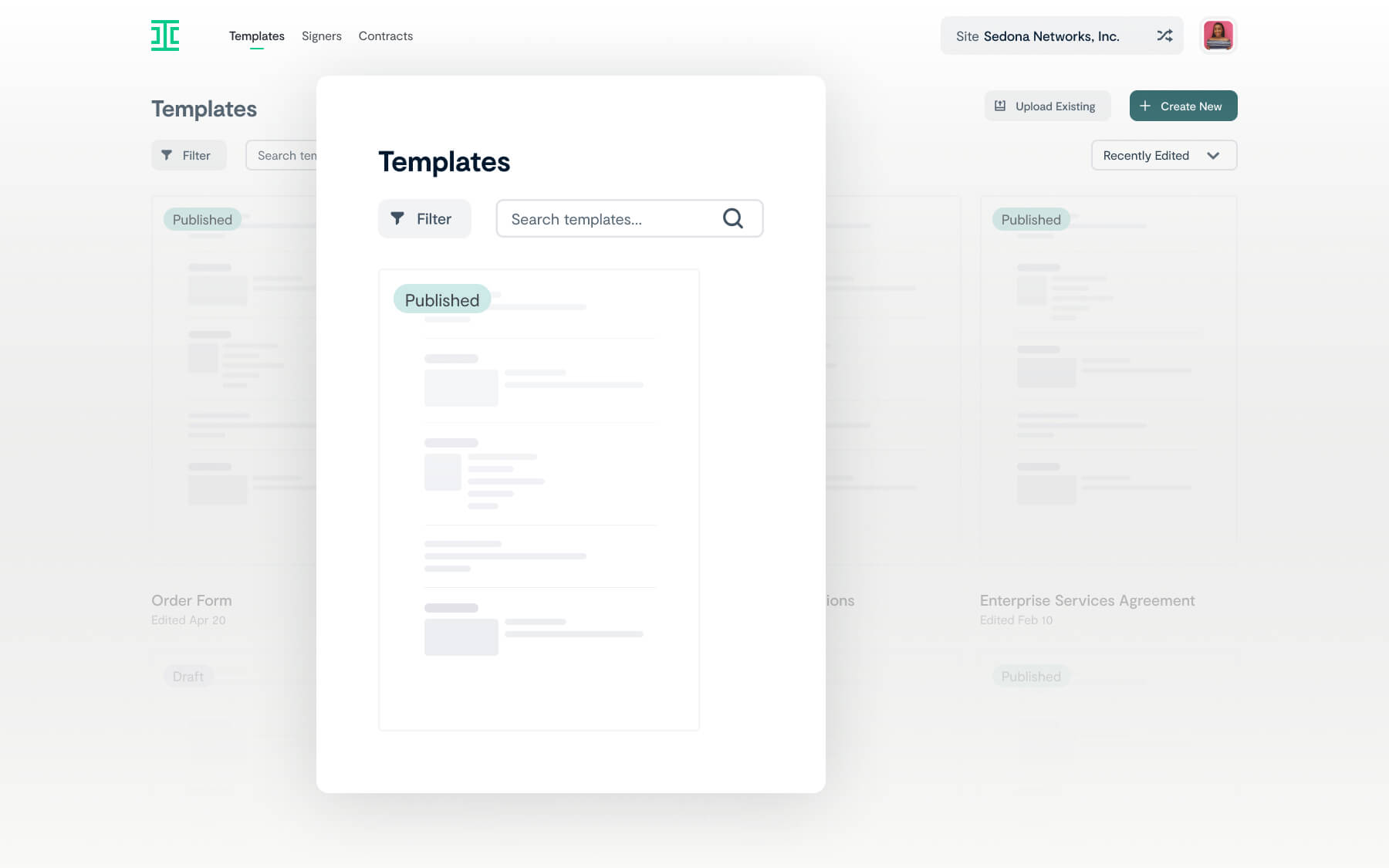

Speed up contract creation time

Ironclad Clickwrap’s user interface was designed for faster, easier contract creation, offering:

- Easy-to-follow, personalized blueprints for implementation

- Simplified version management without the need for dev resources

- Contract template uploading and editing functionality

"With Ironclad Clickwrap, our NDA signature turnaround time was cut down from 26 days to just 2 minutes."

Daniel Michalek

Legal Operations Manager

Branch

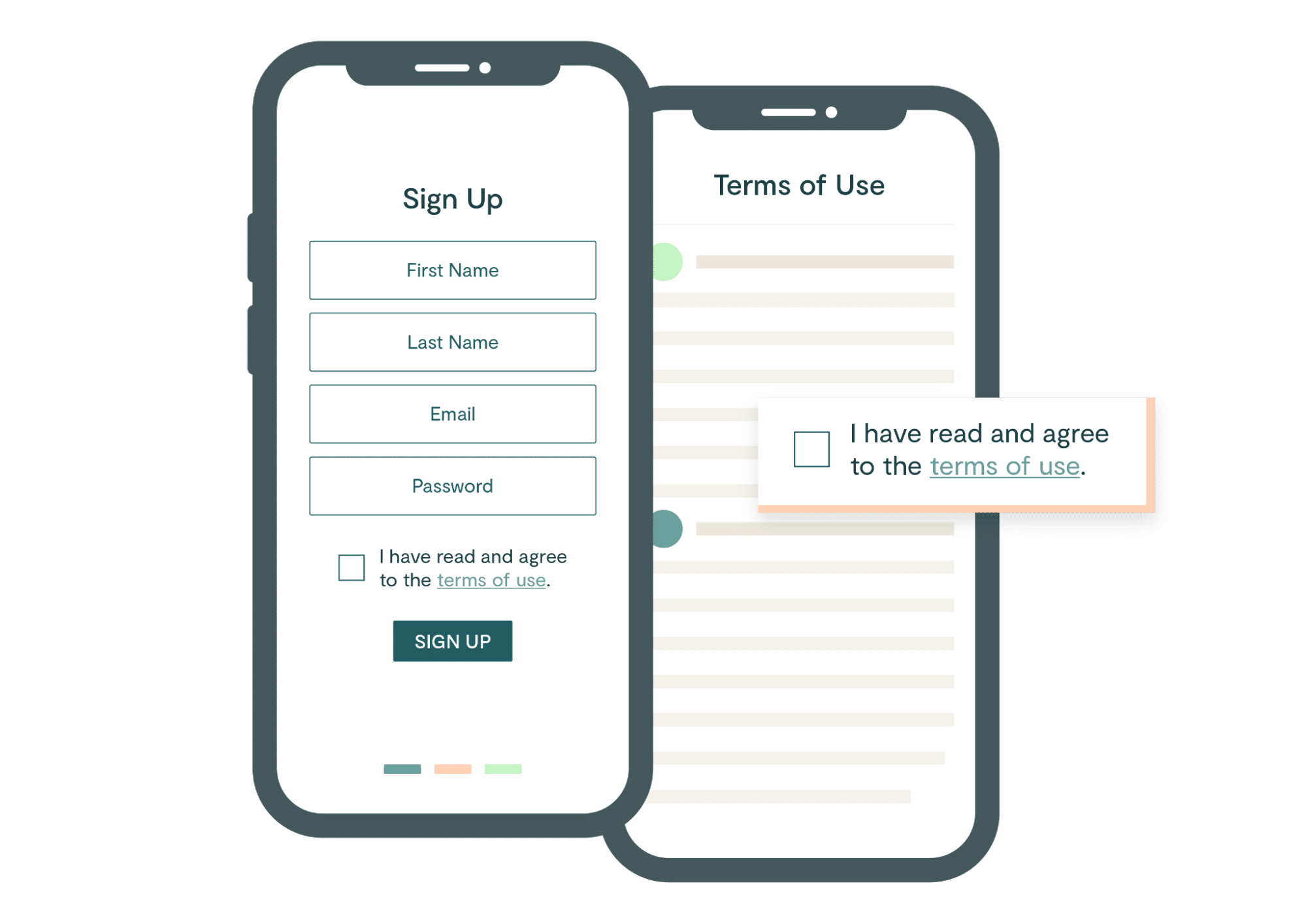

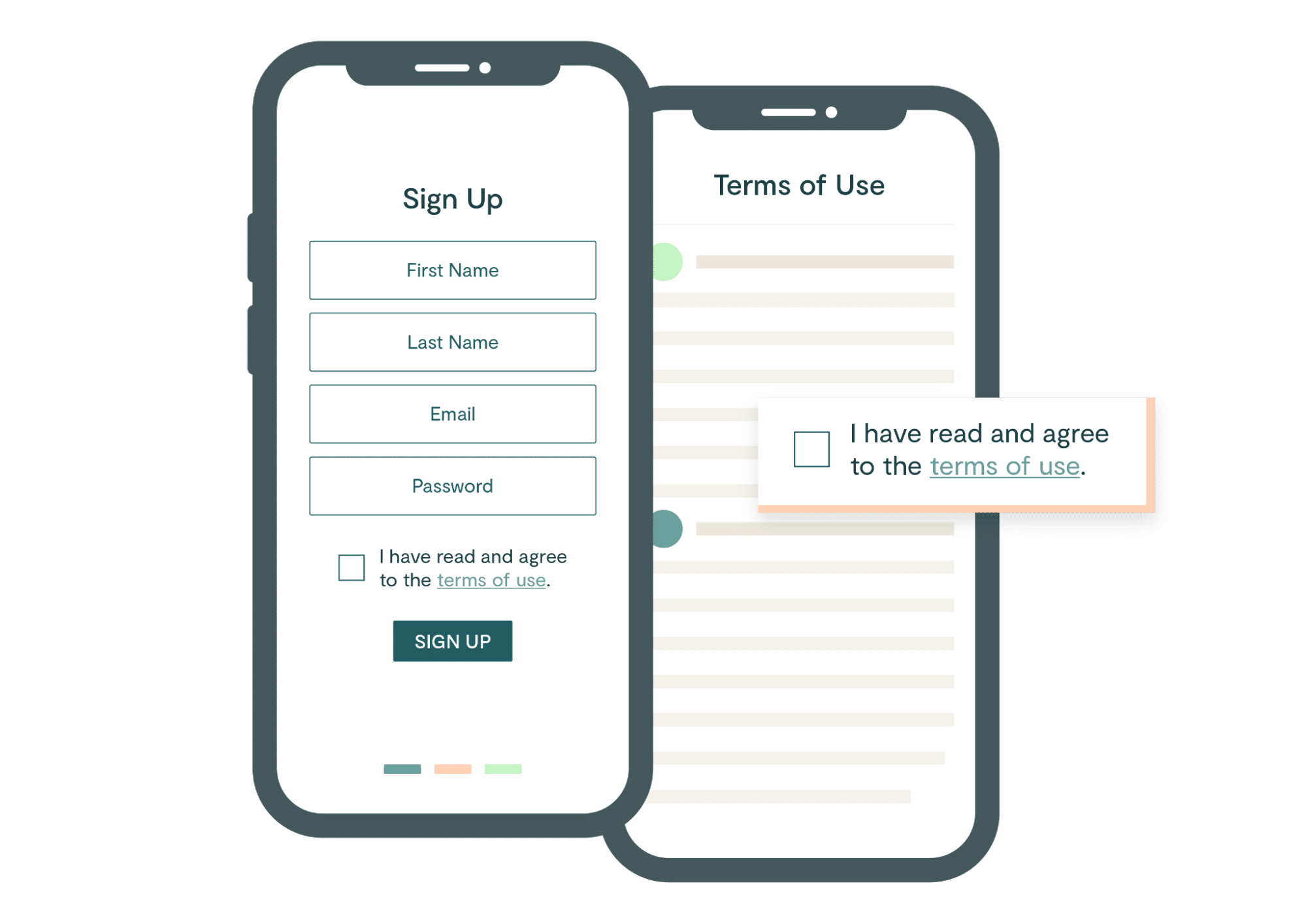

Get to acceptance faster

Purpose-built to make one-click acceptance seamless on any device, Ironclad Clickwrap will:

- Eliminate back and forth on low risk or non-negotiated contracts

- Ensure that the right agreements are presented at the right time

"Time to acceptance is down a ton, so our reps are happy. And our legal team is saving dozens of hours a month not having to field questions or do anything with these lower value agreements—they can focus on the more important deals."

Sheena Ferrari

Head of Global Legal Operations

Snap Inc.

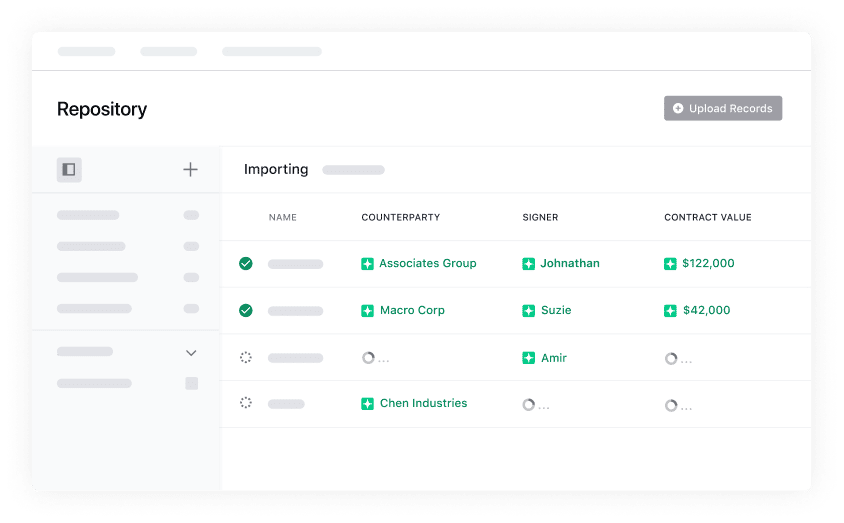

Mitigate risk with the power of Ironclad Clickwrap

Clickwrap agreements tend to have a high enforceability rate given that they require users to agree to the terms. Ironclad Clickwrap doubles down on protection, providing:

- Snapshots, a feature that automatically captures visual evidence from wherever the agreement lives

- Easy contract tagging, storage, and metadata search functionality

Stephen Chu

Chief Legal and People Officer

InStride

Ironclad's Clickwrap enabled us to intake and organize a large volume of contracts. Without Ironclad, we would have spent considerable time and resources to attempt to build a solution of our own.

Read the customer storyWant to learn more?

See how Ironclad Clickwrap can help you transform how you engage with customers and tap into new opportunities.